Best Car Insurance Companies Of January 2023

Best Car Insurance Companies Of January 2023

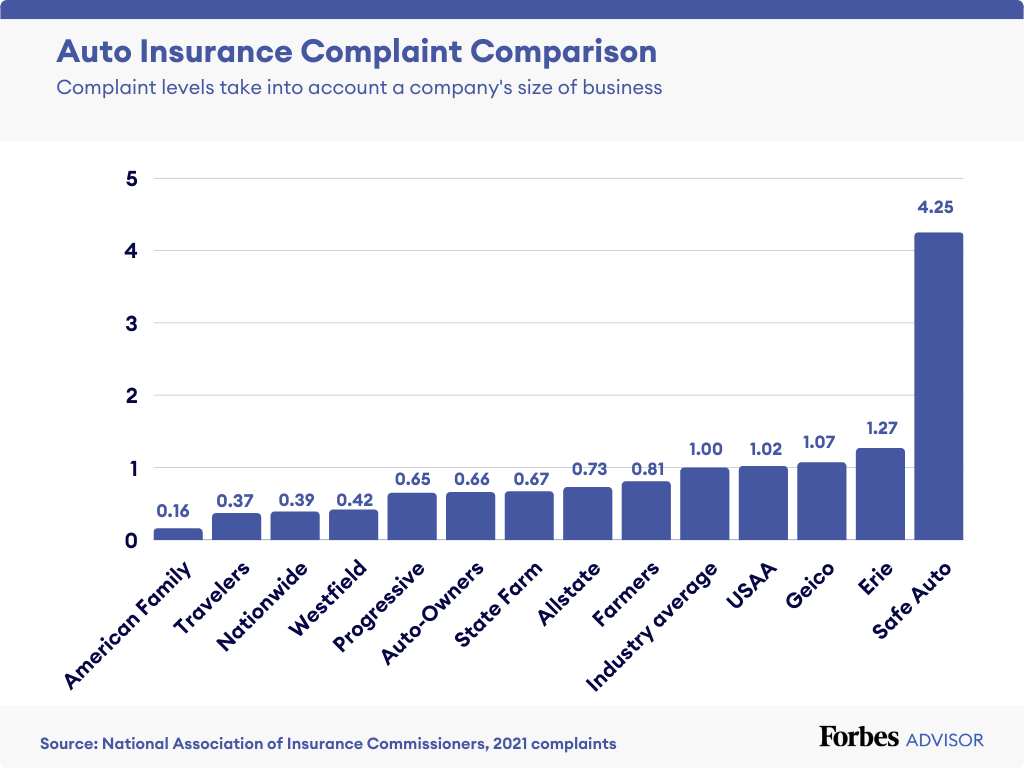

Once you decide how much car insurance you need, it’s time to start shopping for a policy. Rates often vary widely among companies for the exact same coverage, so it’s smart to compare car insurance quotes from multiple insurers. For example, in California, rates for a good driver range from $1,668 (Wawanesa) to $3,940 (The Hartford)—a range of about $2,270 for the exact same driver.

Here’s what you should do to find the cheapest car insurance.

1. Shop around

If you don’t shop around, you won’t know if your rates are on the high end or the cheapest. Getting multiple quotes will help you find the most affordable car insurance company. You can find free quotes online or by working with an auto insurance agent. Independent insurance agents can provide quotes from multiple companies. Insurance quotes are always free.

2. Ask about discounts

Ask about car insurance discounts when you’re getting car insurance quotes. You can typically knock down your car insurance costs with discounts for:

- By “bundling” multiple insurance policies from the same company, such as auto and home insurance.

- Insuring more than one vehicle with the same company.

- Qualifying for a good driver discount.

- If you have a student on the policy, getting a discount if they’re a good student.

- If you have a college student on the policy, snagging a discount if they’re away at school without a car (usually must be at least 100 miles away).

- Taking a defensive driving class if you are age 55 or older.

- Paying your car insurance bill in full for the term rather than monthly.

3. Choose a higher deductible

Collision and comprehensive coverage have a deductible. The deductible is the amount of money a car insurance company deducts from an insurance claims check.

The higher your deductible, the less you’ll pay for insurance.

Here’s an example. Let’s say you get into an accident and your car suffers $2,000 worth of damage. If your collision deductible is $500, the insurer will deduct that from the settlement amount, so you’d get a $1,500 check to cover the repairs.

If you decide on a high deductible, try to set aside money for that deductible, so you have it available if you need to file a claim later.

4. Ask about pay-per-mile policy if you don’t drive much

If you own a car but take public transportation to work and don’t drive your vehicle much, check out pay-per-mile auto insurance policies.

These policies charge a monthly base rate and also a per-mile rate. They can be a more affordable option if you don’t spend much time behind the wheel.

PasarPolis targets insurance gap with full stack

Indonesian insurtech’s ecosystem aims to improve access for country’s underinsured

Let’s say your pay-per-mile insurance has a base rate of $40 a month and a 5-cent per mile rate. If you drive 500 miles in a month, your monthly bill would be $65 ($40 plus 500 miles times $.05).

5. Ask about usage-based car insurance

Usage-based insurance (UBI), also called telematics, may sound like pay-per-mile, but it’s quite different. With a usage-based insurance policy, the car insurance company tracks your driving closely and creates a driving score.

For instance, a usage-based insurance program might track your speed, braking, acceleration, miles driven and time of day. The program will use a smartphone app or a device attached to the vehicle to track your driving.

These programs often come with an initial discount and then you may save more based on your driving. But not all drivers with UBI can save money. These programs are best suited for excellent drivers.