Best of Artemis, week ending March 10th 2024 – Artemis.bm

Here are the ten most popular news articles, week ending March 10th 2024, covering catastrophe bonds, ILS, reinsurance capital and related risk transfer topics. To ensure you never miss a thing subscribe to the weekly Artemis email newsletter updates or get our email alerts for every article we publish.

Ten most read articles on Artemis.bm, week ending March 10th 2024:

- ECMWF forecast for 2024 hurricane season seen as particularly aggressive

Seasonal forecasts for tropical storm and hurricane activity issued at this time of year are often seen as needing to be taken with a large pinch of salt, but another early forecast from the ECMWF is seen as particularly aggressive. - Property cat pricing power could fall 5% to 10% at mid-year: AIFA conference

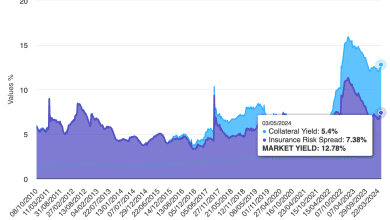

According to a report from analysts at BMO Capital Markets, a prominent reinsurance broking executive from Howden Tiger said that property catastrophe pricing power is likely to fall by up to 10% at the upcoming mid-year reinsurance renewal season. - Catastrophe bond issuance already on-track for biggest Q1 ever

Catastrophe bond issuance recorded by Artemis so far in 2024 has already surpassed $2.8 billion and when we include all the remaining cat bonds that are still being marketed and are scheduled to settle before the end of March, the first-quarter 2024 total is on-track to set a new record for the period. - Everest’s Mt. Logan Re makes two senior investor relations hires

Mt. Logan Re Ltd., the Everest Group owned and operated third-party investor capitalised reinsurance sidecar-like investment structure, has strengthened its investor relations team with the addition of two key hires. - Aon promotes Romeo to CEO Bermuda Reinsurance, Fox remains Chair

Aon has promoted Roman Romeo to become the new chief executive officer (CEO) for its Bermuda Reinsurance Solutions unit, while Tony Fox is set to remain in place as chairman. - Reinsurance returning to normalcy, but property risk pricing to rise: Lockton

Lockton anticipates that primary property insurance prices in the United States will continue to rise, even as the reinsurance market levels out after an influx of capital and recovering appetites from reinsurers. - Outflow trend over for collateralized reinsurance funds and sidecars: Fitch

Fitch Ratings believes that the trend of net outflows that has been seen across insurance-linked securities (ILS) funds and structures that allocated capital directly to private reinsurance and retrocession arrangements is now over, with assets now deemed more stable, suggesting a chance of more consistent growth is ahead. - Jamaica targets four hurricane season catastrophe bond renewal: Finance Minister

Jamaica is looking to renew its catastrophe bond cover that expired at the end of 2023 and the country’s Finance Minister Nigel Clarke said yesterday that a longer-term of protection will be sought with a new cat bond deal, with four hurricane seasons of cover to be the target. - NHC hurricane Otis report suggests Fonden Class D cat bond loss will be ~50%

The U.S. National Hurricane Center (NHC) has delivered its final tropical cyclone report for 2023’s hurricane Otis, putting the minimum central pressure of the storm at 922mb and 929mb at landfall on the Mexican coast, which we’re told still suggests the $125 million IBRD / FONDEN 2020 Class D tranche of catastrophe bond notes face around a 50% loss. - Universal aims to expand in Florida again, secures 90% of first-event reinsurance

Universal Insurance Holdings, a Florida headquartered insurer that is a bellwether for signals of appetite for risk and use of reinsurance for those operating in the state, is aiming to expand its business in Florida once again, with its CEO citing much better conditions after the legislative reforms.

This is not every article published on Artemis during the last week, just the most popular among our readers over the last seven days. There were 31 new articles published in the last week.

To ensure you always stay up to date with Artemis and never miss a story subscribe to our weekly email newsletter which is delivered every Wednesday.

Get listed in our MarketView directory of professionals.