Allstate lifts Nationwide cat reinsurance tower by $1bn to $7.9bn, helped by cat bonds – Artemis.bm

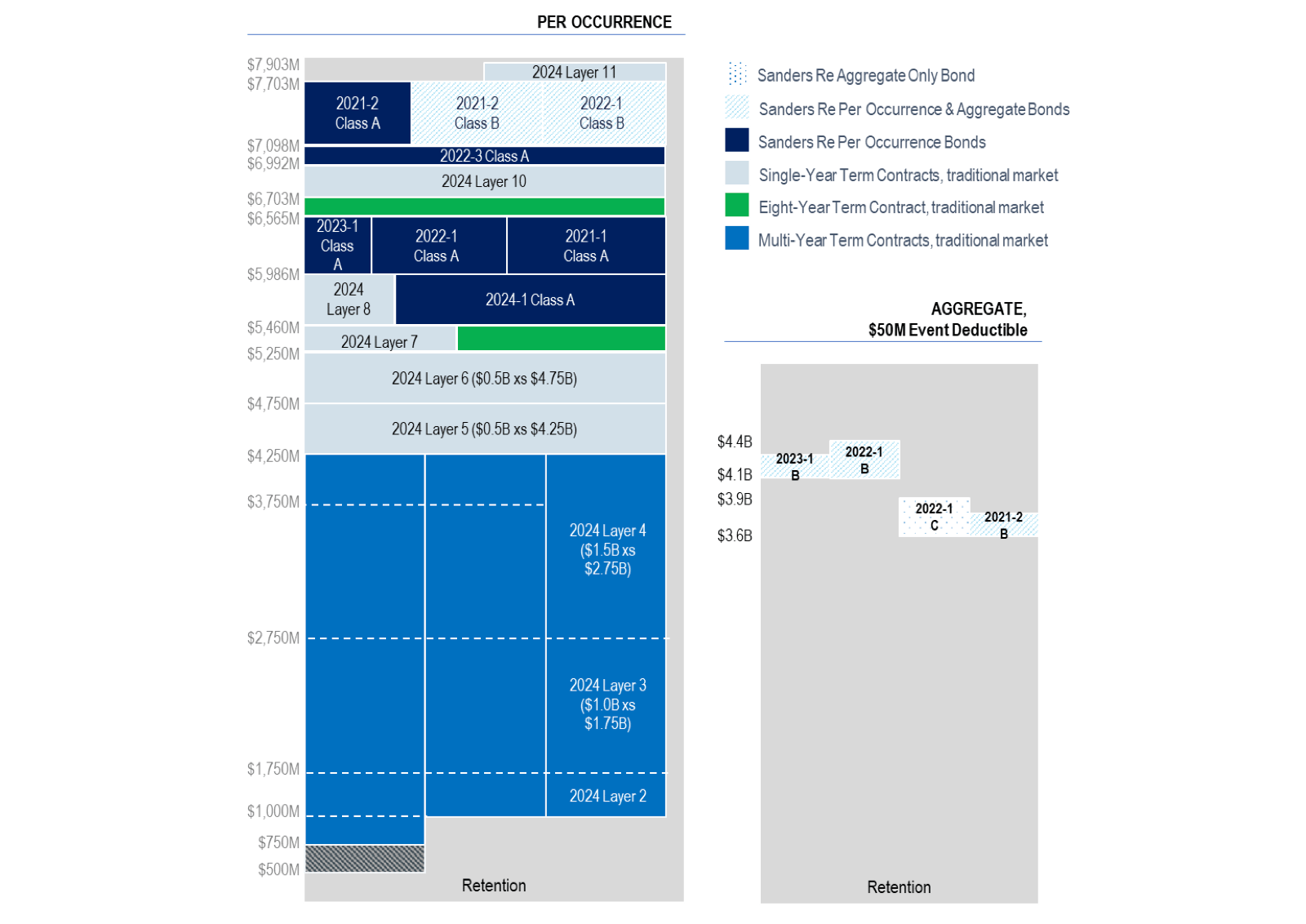

Allstate has significantly lifted the top of its Nationwide excess catastrophe reinsurance tower to just over $7.9 billion, which is almost a $1 billion increase from the prior year and catastrophe bonds are filling out much of the upper-layers.

Catastrophe bonds now occupy portions of Allstate’s reinsurance tower from $5.46 billion right the way up to $7.7 billion, with the Sanders Re cat bond program filling out a significant proportion of the upper-layers of the insurers program.

Secured for 2024, the $400 million Sanders Re III Ltd. (Series 2024-1) catastrophe bond issued in January is the most recent ILS market addition and occupies an important slot in the tower, covering 76% of a layer attaching at $5.46 billion and running to almost $6 billion of losses.

Significant new traditional reinsurance purchases have also bulked out the tower and helped Allstate to grow it to the new approaching $8 billion level.

But, at the same time as the top of Allstate’s main nationwide catastrophe reinsurance tower extending by approximately $1 billion, at the other end there is more risk now being retained.

Where as, in 2023, Allstate’s Nationwide Excess Catastrophe Reinsurance Program covered it for losses of up to $6.92 billion after retentions of between $500 million and $750 million, the retentions have now increased.

For 2024, Allstate’s Nationwide catastrophe reinsurance tower provides coverage for loss events up to $7.90 billion, after retentions of $500 million to $1 billion.

Another notable change is that Allstate no longer has aggregate reinsurance coverage that features a franchise deductible.

With the aggregate reinsurance tower solely provided by catastrophe bonds, the old Sanders cat bonds that had a $1 million franchise deductible are no more.

Now, Allstate only has four tranches of cat bonds that provide aggregate reinsurance, but feature a $50 million event deductible instead.

Recall that, we reported recently on the last tranche of aggregate cat bond notes that featured a franchise deductible to reveal that qualifying losses from the risk period that ended March 31st 2024 are now very close to attaching the coverage and so Allstate may benefit from recoveries under that tranche, should loss development continue.

But, that tranche was due to mature anyway, so no longer features in the insurers reinsurance programs from April 1st this year. But it will stay available for any recoveries that can be made, should the aggregate loss tally creep higher and attach the coverage.

Placed in the traditional reinsurance market in 2024 for Allstate were multi-year contracts attaching at the $500 million to $1 billion retentions and providing coverage of up to $4.25 billion, so exhausting at $4.75 billion.

In addition, Allstate placed two eight-year term reinsurance contracts, that provide it $105 million of cover in excess of a minimum $5.25 billion retention and $131 million of cover in excess of a minimum $6.57 billion retention.

Allstate also placed five single-year term reinsurance agreements in 2024 as well, which have a range of attachment and exhaustion points throughout the Nationwide catastrophe reinsurance tower.

You can see how Allstate’s Nationwide reinsurance towers looked at April 1st 2024 below:

Allstate also purchased a Canadian catastrophe reinsurance arrangement at January 2024, providing total coverage of CA$355 million in excess of a CA$75 million retention.

One other notable fact, related to Allstate’s reinsurance arrangements for 2024, is the increased cost associated with its procurement.

While more limit has been secured, the cost of Allstate’s reinsurance has risen faster, it seems.

Allstate said that the total cost of its property catastrophe reinsurance programs, excluding reinstatement premiums, was $286 million in Q1 2024, compared to $219 million in Q1 2023.

In addition, Allstate has disclosed that its reinsurance arrangements cost it $1.02 billion in 2023, which was up significantly from $788 million in 2022.

But, Allstate has been steadily filling out the upper-layers of its reinsurance tower over the last two years, largely with catastrophe bonds, and has now extended it by almost $1 billion, so the increased costs are understandable, along with the effects of the hard reinsurance market.

View details of every catastrophe bond ever sponsored by Allstate here.